The Composite Benefit Rate Add-On (Prop 2)

The Composite Benefit Rate Add-On is a payroll assessment, with no impact to income (i.e. no income assessment).

Only Charts 3 and S are included.

The assessments are based on specific payroll Object Consolidations and Expense (EX) account types only.

- Object Consolidations: SB01, SB02, SB03, SB04, SB05, SB06, SB07, SUBS, SUBG, SUBX

Accounts with the following attributes are excluded:

- Sub-Fund Group Type: 1, B, C, D, F, G, H, J, L, N, P, S, V, W, X

- Sub Fund Groups: SSEDAC, SSEDPI, and OSSSO

- UC Funds: 19942, 20094, 20095, 20321, 20323, 99100, 99300

The assessment rate is based on UC Office of the President estimates of the payroll assessment that would have otherwise been required if equivalent funds had instead been borrowed from STIP (cash reserves) and repaid over time. The rate is the same for all Chart 3 and Chart S accounts. Chart H will be assessed separately. A detailed breakdown of the annual assessments and the 2017-18 estimated assessment by unit and fund type is available on the Budget & Institutional Analysis Composite Benefit Rate Add-On Overview.

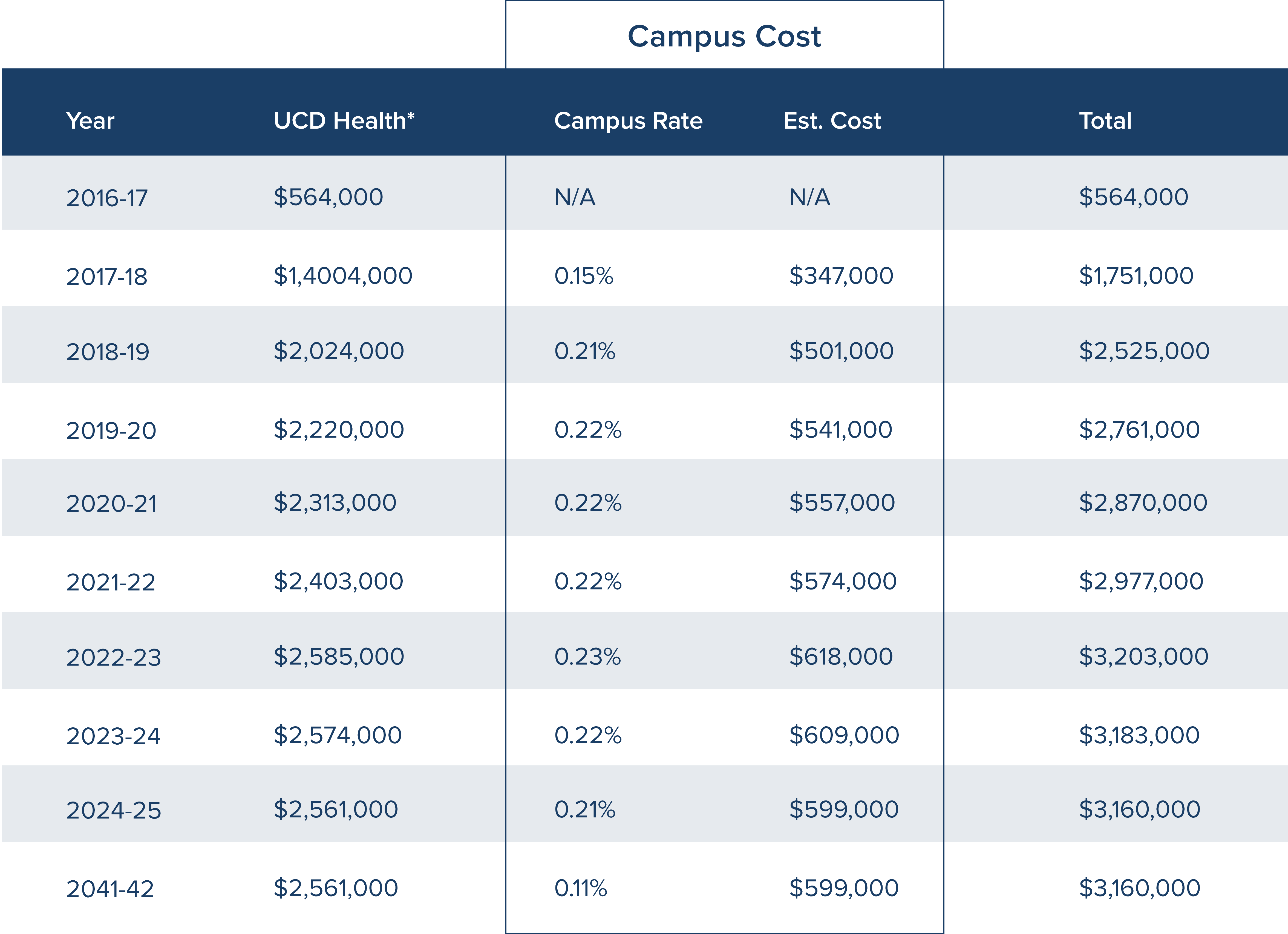

As additional funds are transferred from the State to UCRP, the annual assessments will increase for several years and then level off until fully paid off by 2041-42, as follows:

*Includes School of Medicine, computed using campus rate

How will it show in the FIS Decision Support (DS)?

The CBR Add-On is a monthly assessment that will be generated at the end of the fiscal period, after all payroll has posted. It will post to Object Code 8510 within Object Consolidation SUB6 - Employee Benefits.

The transaction line description will show as CBR Add-On Assessment Month (MM) - Year (YY).

Questions?

Contact Budget & Institutional Analysis for general questions. Other questions can be directed to the FIS Help Desk.